It’s very easy to find graphics that compare the cost of several forms of emerging energy technologies. In the case of fuel cells, since they make electricity to perform a task, the metric used is the cost of a unit of electricity: (pick your currency) per kilowatt-hour or cents/kWh. In vehicular applications, an attempt is made to equate hydrogen fuel with gasoline, generating the absurdly fictitious “gallon of gasoline (or liter of petrol) equivalent” or GGE. If you see these metrics used, you are witnessing one of the greatest failures of the fuel cell industry: its inability to articulate its worth.

Allow me to demonstrate how daft and self-defeating these comparisons can be. We all use batteries in our daily lives. Batteries generate electricity, which we put to good use. The going rate for AA batteries is broad, but to pick a number, a 4 pack of Energizer batteries is $4.01, or about $1/battery.

Each battery provides a little less than 3 watt hours of electricity. That means that if you compared AA batteries with other forms of generation, its output would be about $330/kWh. Now let’s take that value and do the conventional comparison with other generation forms, shown below. Note that this uses a logarithmic scale.

Clearly it looks horribly expensive. But here’s the thing- we don’t value the AA battery for its costs of electricity, we value it for its convenience and size. Relative to other kinds of electricity generation, it costs a fortune, but only because we are using the wrong metric. A friend and mentor reminds me frequently that what is being sold is the product of the product, not the product itself. And so it goes with fuel cells.

This is readily apparent in three applications where fuel cells are deemed commercial and where sales are happening every day: remote telecommunications backup power; uninterrupted storage and as replacement drives for battery systems in materials handling equipment. In each case, what make the fuel cell commercially viable is its context in an economic system that values the attributes of its output, not the actual output itself. Consider any of the following factors:

- Avoided costs of equipment to achieve desired level of enhanced:

- Reliability

- Power Quality

- Avoided costs of battery maintenance and disposal

- Value of quiet operation

- Avoided fees and penalties for emissions for certain industries

- Longer operational periods in EPA non-attainment areas

- Much longer operation in battery replacement applications

- Portability

Each one can be valued and monetized in the overall economic equation.

Total Cost of Ownership (TCO)

A far better metric and methodology for evaluating the commercial viability of fuel cells is total cost of ownership (TCO), a form of life cycle cost analysis. Investopedia defines TCO as “The purchase price of an asset plus the costs of operation. When choosing among alternatives in a purchasing decision, buyers should look not just at an item’s short-term price, which is its purchase price, but also at its long-term price, which is its total cost of ownership. The item with the lower total cost of ownership will be the better value in the long run.”

Materials Handling Equipment

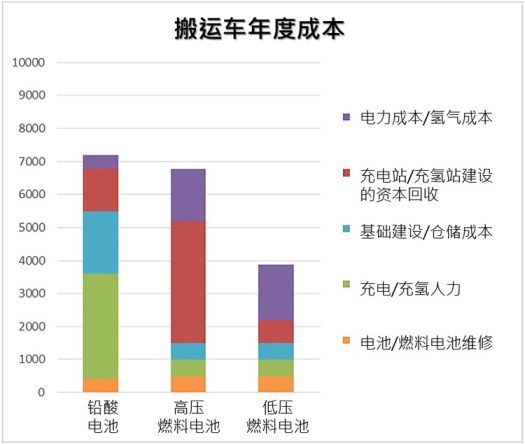

Use of TCO is best illustrated by the business case for fuel cell replacements in electric drive systems for materials handling equipment. Virtually all indoor forklift trucks are battery powered electric units. A recent DOE report provides a detailed analysis, summarized below.[i]

The relevant costs of ownership include the following items:

- Cost of the bare forklift

- Cost of the required battery or fuel cell systems

- Cost of battery changing and charging or hydrogen fueling infrastructure

- Labor costs of battery changing or hydrogen fueling

- Cost of energy required by the forklifts

- Cost of facility space for infrastructure (indoor and outdoor)

- Cost of lift truck maintenance

- Cost of battery or fuel cell system maintenance.

When each of these cost elements are evaluated, the following table results for a hypothetical Class I or Class II forklift:

| Total Annual Cost of Ownership | ||

| Cost Element | Battery Drive Forklift | Fuel Cell Drive Forklift |

| Amortized cost of truck | $2,800 | $2,800 |

| Amortized cost of Battery or Fuel Cell Unit | $2,300 | $2,600 |

| Per Truck Cost of Charging Battery/ Fuel Cell Hydrogen Fueling Infrastructure | $1,400 | $3,700 |

| Labor Cost for Charging or Refueling | $4,400 | $800 |

| Cost of Electricity/Hydrogen | $500 | $2,400 |

| Infrastructure Warehouse Space | $1,900 | $500 |

| Forklift Maintenance | $2,800 | $2,800 |

| Battery/ Fuel Cell Maintenance | $3.600 | $2,200 |

| Total Cost of Annual Ownership | $19,700 | $17,800 |

If one only looked at the total costs of the forklift plus drive unit, the fuel cell unit is more expensive. Add in the cost of charging batteries, the cost of hydrogen and the charging/fueling infrastructure, the fuel cell looks that much worse. Now factor in the productivity costs or gains: the labor cost for refueling a fuel cell is far less than that of a battery unit; the warehouse costs are far less, as is the maintenance costs of the drive units. At this level of analysis, the fuel cell drive is the clear winner, although it represents a discrete set of values. An analysis which looks at the sensitivity of each of these parameters underscores the clear choice of the fuel cell drive unit.

Source: NREL

There are other increases to productivity for the fuel cell that these analyses do not capture. Over a normal shift, the battery loses capacity such that near the end of a shift it cannot lift the same amount of material to the same heights. Fuel cell units retain their power as long as they have fuel available. In some cases, more electric drives need to be purchased to compensate for long battery recharge times and the diminished capacity of units over shifts. Finally, while the costs of battery maintenance are included above, the environmental cost of battery disposal are not. Fuel cell units do not have that problem.

A similar analysis can be performed for remote telecom site backup. In this case, the fuel could either be a liquid (operating a methanol fuel cell), or compressed hydrogen. Diesel generators or battery units require maintenance, with very high labor costs attributed to simply getting to the site and returning. A fuel cell unit, once installed and made ready for operation, eliminates a considerable amount of potential labor costs. In addition, it does its work without emissions and without noise.

Gallon of Gas Equivalent

The GGE metric, when applied to hydrogen fuel cells, is one of the most inappropriate attempts to compare one type of fuel system with another. Clearly it was created on the assumption that it would be easy for the general public to understand. All it does is obfuscate reality. GGE works as a comparison basis when we are talking about fuel use in an internal combustion engine which resides in a vehicle that was designed with an internal combustion engine. Period. The only time GGE would apply to a hydrogen fueled vehicle would be if hydrogen was being combusted in a conventional engine. Further, GGE by definition relies on petroleum economics to set price and petroleum market dynamics have nothing to do with the cost of hydrogen. A fuel cell vehicle is designed to accommodate a fuel cell and make best use of its attributes. It is far more efficient than combustion engines and makes best use of the available electricity to incorporate features not found in today’s vehicles.

The introduction of fuel cell vehicles offers the opportunity for end users to think about their transportation quite differently from what is on the road today. Instead we persist in talking about these new vehicles in terms that do not fit. Most egregious is the continued use of GGE as a filter to determine where R&D funding should go for hydrogen vehicles and refueling infrastructure. For several years, if someone guessed that a particular project or concept could not beat $3.50 GGE it was rejected. Achieving lowest cost is certainly a goal but using the wrong yardstick is just plain stupid.

A far more appropriate metric for comparing new and emerging vehicles (and the R&D associated with them) is cost per distance. This metric would apply to fuel cells and to electric vehicles.

Emerging Energy Metrics

As new forms of energy emerge in this new energy economy as much care needs to be taken in their evaluation to assure that we take fully into account the change in perspective that comes with them. The risk in using old methods to consider new concepts is that we miss altogether their potential.

[i] Ramsden, Ted USDOE “An Evaluation of the Total Cost of Ownership of Fuel Cell-Powered Material Handling Equipment” NREL/TP-5600-56408. April 2013