For years, grid reliability has been locked into an outdated framework that sees power generation as a rigid hierarchy. In this model, baseload power plants, typically coal, nuclear, or large hydro, provide the system’s foundation. Intermediate plants ramp up as demand rises, and peaker plants fire to handle extreme conditions. This rigid sequence has shaped how we plan, regulate, and invest in electricity infrastructure.

However, clinging to this traditional model is holding us back. Thanks to new technology, smart energy management, and flexible power use, we now have better ways to keep the grid stable—especially in New England, where winter storms, high electricity costs, and limited natural gas supply complicate energy planning.

A recent Duke University study, Rethinking Load Growth, offers critical insight into how large electricity loads like data centers, industrial electrification, and managed demand response, when operated flexibly, can actually enhance reliability and minimize the need for new power plants. Instead of obsessing over the diminishing role of traditional baseload power, the New England grid should embrace this dynamic, adaptive reliability model—one where flexible demand, smart grid coordination, and intelligent load balancing take center stage.

Myth: Renewable Energy is “Unreliable”

Critics of renewable energy often argue that wind and solar threaten reliability because they are “intermittent.” The logic goes that the grid will become unstable without a steady supply of fossil or nuclear power running 24/7. But this fear is rooted in an outdated view of how electricity systems function. The grid does not operate on a simple “always-on” philosophy—it is a highly dynamic system, constantly responding to shifting conditions in supply and demand.

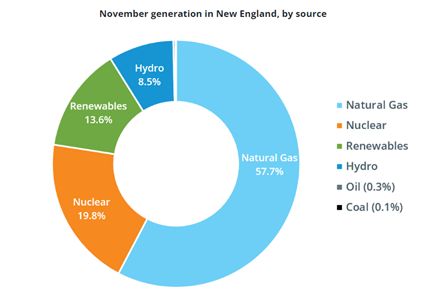

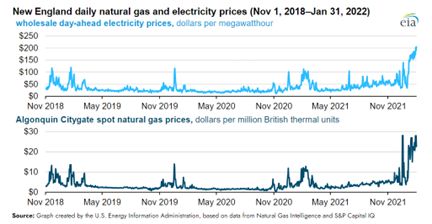

In reality, all power sources are variable—not just renewables. A nuclear plant can experience an unexpected outage. Gas-fired power plants depend on pipeline infrastructure that can freeze or fail, as New England has experienced during extreme cold snaps. Even coal plants have been forced offline due to fuel supply chain disruptions. The notion that “baseload” is inherently reliable is not just misleading—it’s dangerous. In fact, a little over a year ago, the CEO of ISO-NE testified before FERC that reliability would be solid for the next several years, in part because of wind and solar energy and the diversity they add to generation sources.

The Rethinking Load Growth report makes clear that the best path forward is a more flexible, adaptive grid—not a rigid one. Instead of fixating on the predictability of individual power sources, we should focus on the predictability of the system as a whole—and that means integrating smart, real-time demand-side management alongside renewable energy.

A Smarter Way to Keep the Lights On

One of the report’s key findings is that ISO-New England (ISO-NE) and other grid operators already have significant headroom to integrate new large loads without requiring massive new investments in power plants or transmission lines. The study estimates that over 100 GW of flexible load could be integrated nationally with only minimal curtailment of operations.

This is a game-changer for reliability. Instead of assuming that the grid must always meet demand instantaneously with generation, a flexibility-first approach allows demand to adjust in response to grid conditions. AI-driven data centers, intelligent HVAC systems, and automated industrial processes can ramp up or down in real time, smoothing variability without requiring new fossil fuel infrastructure.

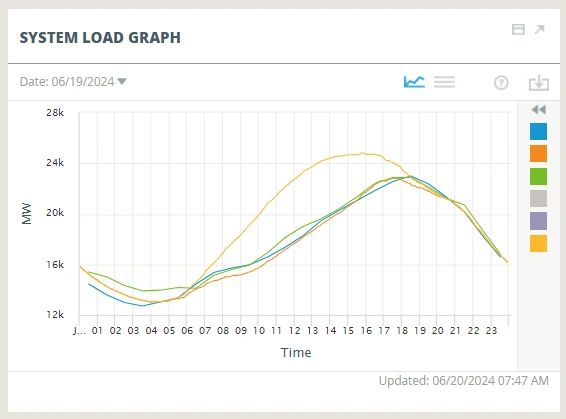

For New England, where winter peak demand is driven by heating loads and constrained natural gas supply, this flexibility could mean the difference between stability and blackouts. Instead of burning more fossil fuels, grid operators could shift demand dynamically—pre-heating buildings when renewable supply is abundant, temporarily reducing non-essential loads during peak hours, or leveraging stored energy from electric vehicle fleets.

Smart Grids and Distributed Resources: A Reliable Future

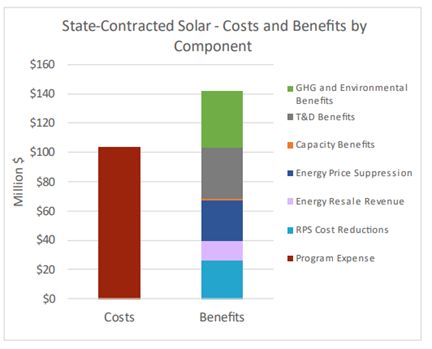

Beyond flexible loads, smart grid technologies and distributed energy resources (DERs) further redefine reliability. Microgrids, battery storage, rooftop solar, and virtual power plants (VPPs) allow for localized energy balancing, reducing dependence on centralized fossil fuel plants.

For example, instead of relying on peaker plants to handle extreme winter cold, ISO-NE could integrate neighborhood-level microgrids powered by a combination of distributed solar, storage, and demand response. When centralized plants are under strain, these localized systems can continue operating—enhancing resilience at a fraction of the cost of new power plants.

Moreover, real-time grid monitoring, AI-driven forecasting, and automated control systems can now predict and respond precisely to fluctuations, which was unthinkable in the old “baseload-first” model. Instead of designing a system that assumes worst-case demand scenarios, we can create one that dynamically adapts to reality.

The Future of the Grid: Smart, Not Rigid

Like other regional grid operators, ISO-New England is beginning to embrace this new paradigm to ensure long-term reliability. That means continuing to:

· Expand demand flexibility programs to reduce peak load strain.

· Modernize how it ensures power plants are available when necessary.

· Invest in real-time grid intelligence to better integrate renewables and flexible loads.

· Facilitate growth of distributed energy resources to enhance local resilience.

It’s time to abandon the hierarchical, generation-first view of reliability that has dominated grid planning for over a century. Grid reliability is no longer about keeping big power plants running 24/7—it’s about using energy in smarter ways. With the right policies, New England and its electric utilities can embrace a clean, flexible, cost-effective energy system that works for the 21st century. We now have the technology, data, and tools to orchestrate a cleaner, cheaper, and more reliable grid than the legacy fossil-based system.

It’s time to leave outdated ideas behind and build a resilient, adaptable system that is ready for anything. The answer is clear: reliability is no longer about baseload but real-time adaptability.