Surely, you’ve seen memes or heard claims that all the new solar installations in Maine are why our electricity costs are so high. Those who make these irresponsible claims—including some public officials—either don’t understand how our energy system works or don’t care. But here’s the truth—the opposite is true.

First, let’s talk about your electric bill.

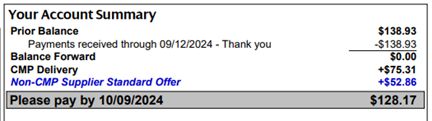

Here is my latest one from CMP.

Two important lines are “CMP Delivery” and “Non-CMP Supplier Standard Offer.”

Despite this labeling, many people don’t realize that CMP does not sell electricity—it only delivers it. They are allowed to charge “CMP Delivery” for that service.

Suppose you are one of the 90% of customers that are supplied by the “Standard Offer.” In that case, the other line on your bill is the cost of electricity bought by the Maine Public Utility Commission from the New England wholesale market. They buy it once a year, usually in November, which fixes the following year’s price.

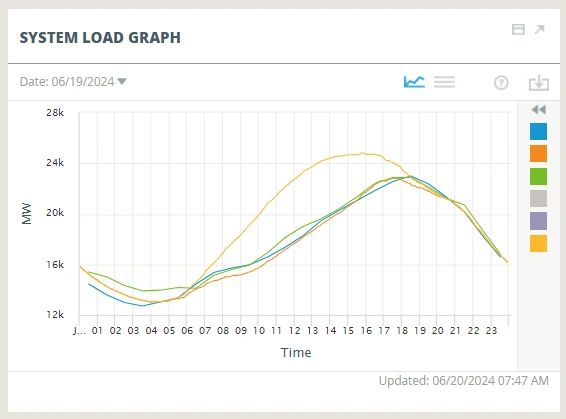

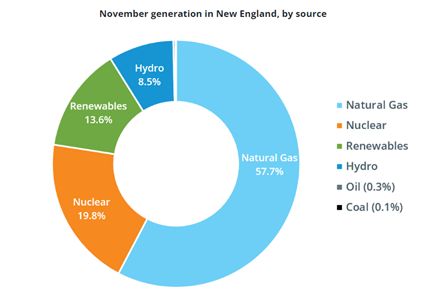

Over half of that wholesale market comes from power plants burning natural gas, which has a significant influence.

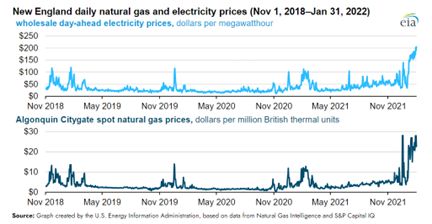

In fact, if you track the ups and downs of gas prices with electricity prices over the last 6 years, they match.

Now, let’s put all the pieces together and look at the total bill. The red parts of the bar are CMP costs. Green is the Standard Offer Supply, and blue is a charge from the regional grid to get electricity into Maine. We’ll talk about the little orange piece in 2023 and 2024 later.

So what can we do about this? It’s easy to see that supply is the real culprit in recent price increases. The best way to reduce that cost is to use less natural gas.

Every new kwh from cheaper sources like solar or imported power from Quebec replaces a kwh currently produced from natural gas.

Without these new sources replacing gas, our bills would be much higher.

Now, to the myth- and it is a myth – that new solar panels in Maine are increasing electric bills.

Non-rooftop solar projects are indeed paid extra, and those costs are built into your bill. Those costs are the little orange slice of the chart above.

But your bill doesn’t tell you about the benefits of solar that keep costs down.

First, solar energy removes expensive natural gas, which, as we saw, directly affects the standard offer price.

Second, the old-fashioned way to meet new grid demand was to install more poles and wires – and their costs are in your bill. Putting new solar panels near where customers need power avoids some of that expense.

Then there’s the environmental benefits. In addition to keeping costs low, solar energy reduces our reliance on fossil fuels, lowers pollution, and helps us meet our climate goals.

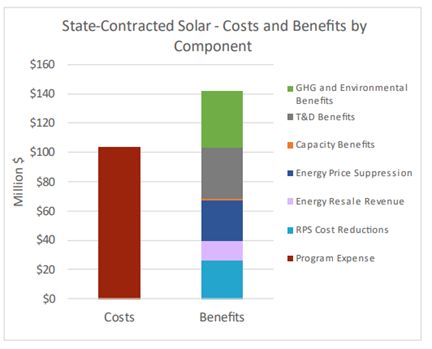

Other benefits that translate to cost savings as well involve increased reliability and additional revenue obtainable in the wholesale power market. The Public Utility Commission recently added these savings up and concluded that for every dollar of solar included in your bill, you saved about a dollar and 40 cents.

The Public Utility Commission recently added these savings up and concluded that for every dollar of unrecovered costs, there was a savings of about a dollar and 40 cents. See this chart:

So the next time someone tries to tell you that solar energy is raising electricity costs, tell them to do their homework!