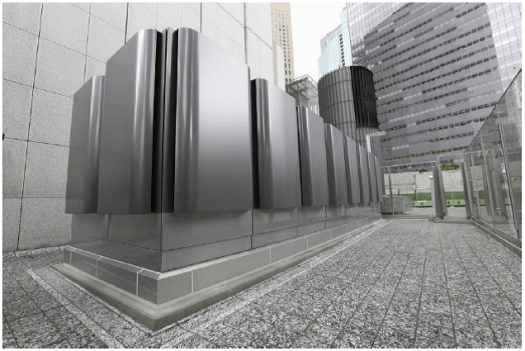

Last July Bloom Energy announced the placement of a 200 kW “Energy Server” (Bloom’s preferred language for “generator”) at Keio University in Japan, another at a large Softbank building in Fukuoka (Softbank is a major Japanese mobile phone service provider), as well as the creation of a 50/50 joint venture with Softbank to establish Bloom Energy Japan, Ltd. These announcements were all part of the steady drumbeat of Bloom unit installations. About the same time, however, Bloom issued a white paper where the President of Bloom Energy Japan, Miwa Shigerumotu, provided some insight into their pricing structure. Below is a picture of the Bloom installation at the Softbank building.

Source: Bloom Energy Japan, Ltd.

As with other installations, Bloom is selling the product of the product, rather than just a piece of equipment. The customers receive full output of the units with no upfront costs, paying a fixed rate of 25 yen/kWh, or about USD 0.21/kWh. This rate is fixed at 10 years, with no fuel adjustment clauses. In the white paper Mr. Miwa acknowledges that 25 yen is high relative to current prices, but goes on to say that the days of predictable electricity prices are over. From April 2010 to April 2014, electricity prices in Japan rose an average of 10% annually. He argues that paying a premium of about 5 yen now will be more than balanced out longer term when compared with the volatile and escalating conventional electricity cost. His bottom line: a Bloom Energy Server provides price hedging and risk mitigation.

Fair enough, but is Bloom likely making money here or just initiating a loss leader program to pave the way for future sales? We can get a very approximate sense of the implied cost of the unit with some reverse economic calculations.

The most significant variable cost to Bloom is fuel price. The Bloom units are running on liquefied natural gas (LNG), which is not an inexpensive commodity in Japan. The chart below gives some perspective to Japanese LNG pricing relative to the US and UK (Blue is US Henry Hub; Green is the UK and Red is Japan). Last winter Japan LNG was at about $19/MM Btu.

Source: National Gas Price in Asia, Rice University

The figure above overlays the timing of the Fukushima disaster and the closure of the Japanese nuclear fleet, which clearly had a major impact on price (and on the price increases noted above by Mr. Miwa). Longer term, however, most analysts do not foresee a return to UK- or US-like pricing in Japan. The Economist forecasts a decline in Japanese LNG price over time.

Whereas the IMF foresees a relatively constant price for the next several years.

Forecasting LNG prices in Japan is further complicated by the fact that, at least historically, Japanese LNG prices have been strongly correlated to world oil prices. It remains to be seen if OPEC’s production announcement keeps oil prices stable in the short term but resulting in an increase when many now uncompetitive shale projects fail to survive, reducing supply.

For the purposes of this approximation, we’ll assume a fuel cost range for our Bloom units between $10 and $19/MM Btu. We’ll also assume that Bloom internally financed the capital cost for these units at about a 2% interest rate.

Along with some other assumptions about O&M costs and taxes, the following break even maximum costs of capital as a function of fuel cost assumptions can be calculated.

| Fuel Cost, $/MMBtu | $/kW installed to achieve 10 year levelized cost of electricity equal to USD 0.21/kWh* |

| 10 | $9,000 |

| 15 | $6,800 |

| 19 | $5,000 |

When the first Bloom units were sold, industry estimates for their cost was on the order of $30,000 kW to $40,000/kW. Perhaps 100 have been sold in the interim. Given that starting point, it seems very unlikely that 100 units could result in economies of scale that would reduce cost by a factor of 5 or 6, as would be necessary for these two examples.

Even given all of the necessary caveats about the very approximate nature of the estimates and assumptions made above, loss leading is the market introduction strategy for Bloom in Japan.

*21 cents uses the current exchange rate – at the time the transaction was completed earlier this year the rate would have been nearly 25 cents US. Perhaps this is why there was a report last month that the current rate is 28 yen/kWh.